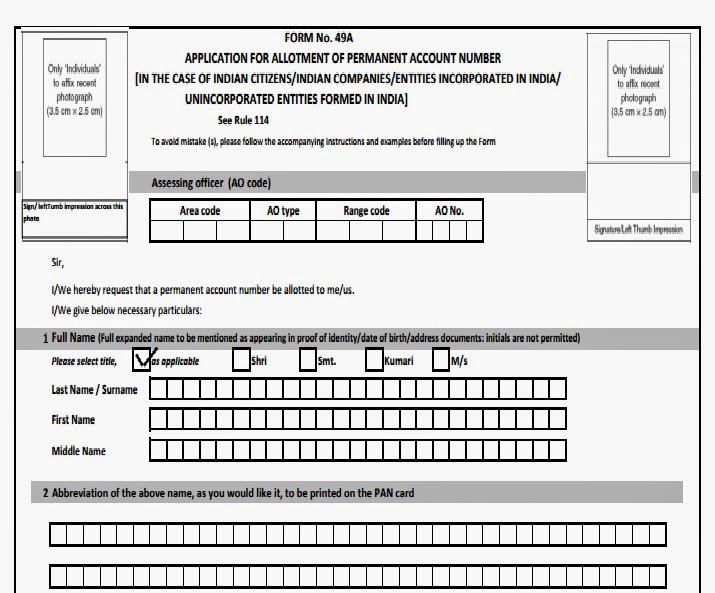

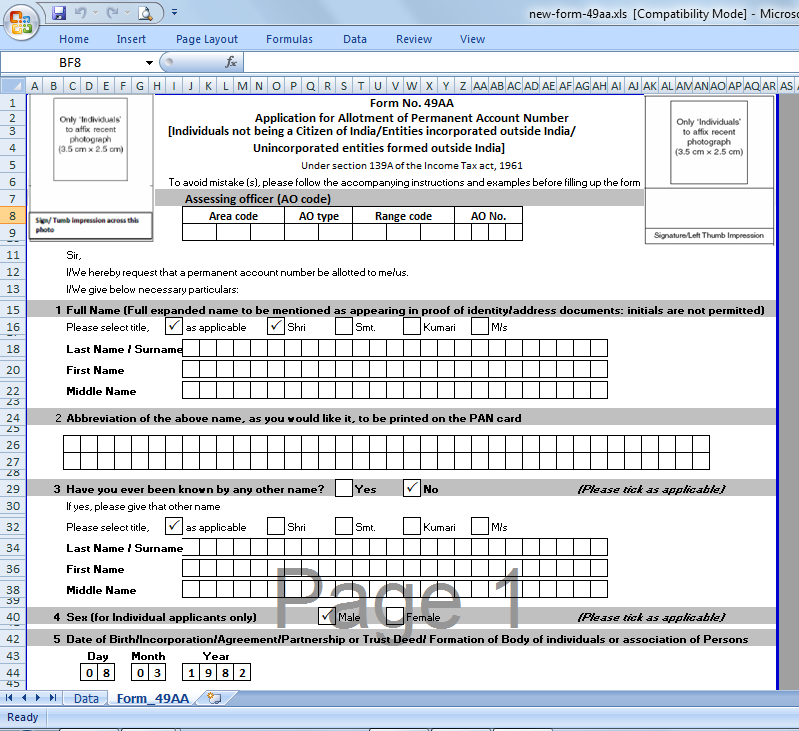

How to Fill Pan Card form Man & Woman Fill form nsdl site pan application & payment full process download pdf APPLY PAN CARD NSDL(2016-2017) HINDI. How to Fill Pan Card form Nsdl: 3 Mintes. How to fill Pan Card Application Form Download PDF Pan Card Application Form 2019 Get UTI, NSDL Pan Card Form Online Download Pan Form 49A & Form 49AA Pan Registration Form. Form 49AA is the application form for the allotment of Permanent Account Number for Foreign residents and entities incorporated outside India. One can download the application form online from NSDL e-Governance official website or UTIITSL website. Download Form 49A Pan Application Form 49A In PDF Format: Are you new to PAN Card? Want to create one for you? Then you need to first download Form 49A and submit it via the official website of PAN. Using Form 49A, people, as well as legal entities, can get PAN card. 49AA Application for Allotment of Permanent Account Number Individuals not being a Citizen of India/Entities incorporated outside India/ Unincorporated entities formed outside India See Rule 114 To avoid mistake (s), please follow the accompanying instructions and examples before filling up the form Assessing officer (AO code). Application for Allotment of Permanent Account Number Individuals not being a Citizen of India/Entities incorporated outside India/. Abbreviation of the above name, as you would like it, to be printed on the PAN card; 3: Have you ever been known by any other name? No (Please tick as applicable).

What is Form 49AA?

Foreign residents and entities incorporated outside of India are also eligible for PAN. Form 49AA is the application form for the allotment of Permanent Account Number for Foreign residents and entities incorporated outside India. One can download the application form online from NSDL e-Governance official website or UTIITSL website. The applicant can submit the form once they have filled it with the correct details and attached the required documents along with the form.

Structure of Form 49AA

Form 49AA is divided into different sections with sub sections to make filling the form much easier for the applicant. The form has designated spaces for the applicant to affix their photographs on the top corners of the form. The form is divided into about 17 components, each with a different attribute.

Click here to download Form 49AAComponents of Form 49AA

Given below is a detailed explanation of all the components present on Form 49AA.

Assessing officer code- In this section, the applicant has to mention the details of the Assessing Officer code details such as the Area code of the accounts office, Accounts office type, Range code and Accounts office number

Full name- This is the part of the form where the individual mentions their marital status along with their first name, last name and their Sur name.

Abbreviation of the name- This is the part of the form where in the applicant has to abbreviate their name based on what they want to be displayed on the PAN card.

Other name- In here, the applicant has to mention the details of their other name if they were ever known by another name other than the name already mentioned.

Gender- The part of the form where in the applicant has to mention their gender.

Date of birth- In case of an individual applicant, the applicant has to mention their date of birth and in case of organisations, they have to mention the date of partnership/incorporation/Agreement or Trust deed.

Father’s name- The applicant has to mention the first name, last name and surname of their father in this part of the form. This is applicable only to individual applicants and even married women should fill in this part of the form.

Address- The applicant needs to enter the details of their residence address and office address in this part of the form. The applicant needs to be careful while filling in the address and should give the correct details.

Address of communication- The applicant has to choose the address at which they would like to be contacted at.

Telephone number and email id- The applicant has to mention their Country code, State code and telephone/mobile number for communication purposes.

Status of applicant- In here, the applicant has to mention if they are an individual, a HUF member, Company, Partnership firm, etc.

Registration number- The registration number indicates the registration number for company, firms, LLPs, etc.

Citizenship- The applicant has to mention the country of their citizenship and ISD code of country of citizenship in this part of the form.

Representative of the applicant in India- In here, the applicant should mention details of the representative or the agent including their address and full name.

Documents submitted- In this part of the form, the applicant needs to mention all the documents they have submitted with the form.

KYC details- This part of the form should be filled in by a Qualified Foreign Investor as prescribed by the regulations under SEBI. This will contain details such as the marital status, occupation details, citizenship status and more.

How to fill Form 49AA?

There are certain rule that an individual or an entity should follow when filling in Form 49AA. Though filing in a form might seem like an easy task, there are some rules that can lead to rejection of your application if ignored. Given below are some of the important rules to keep in mind while filling in Form 49AA.

Basic rules of filling Form 49AA- The applicant should fill in the form only in English and not any other language. The form should be filled in block letters and each box in the form can contain only one character. The applicant is also advised to use black ink to fill the form, it is better to use a ballpoint pens and avoid liquid ink pens as the latter might make the form look splotchy.

Thumb impression and signature on photographs- The applicant is required to provide signature or left hand thumb impression on the photograph attached to the left top corner of the form. The applicant should sign or leave a thumb impression in such a manner that it can be seen on the photograph as well as the form.

AO code details- The AO Code details such as Area Code, AO Type, Range Code and AO number should be filled by only the applicant and the applicant can avail the details can be availed from the Income Tax office or from one of the PAN centres.

Accuracy of the information provided- It is important to provide accurate details while filling the form. Providing the wrong or incorrect details can create a lot of complications including rejection of the application for PAN.

Contact details- The applicant has to provide the ISD code for their phone number since they reside outside India. It is also important that they provide the country name along with the Zip code for the country.

Where can I submit my online printed PAN card form?

Applicants can submit their filled up forms along with the copies of required documents at the NSDL office or at the UTIITSL office. To submit at NSDL office, the application needs to be sent at -

Income Tax PAN Services Unit,

NSDL e-Governance Infrastructure Limited,

5th Floor, Mantri Sterling,

Plot No. 341, Survey No. 997/8,

Model Colony, Near Deep Bungalow Chowk,

Pune – 411 016

If the applicant has applied for the Permanent Account Number from UTIITSL, the application form along with the relevant documents can be submitted at any of the addresses mentioned below:

PAN PDC Incharge – Mumbai region

- UTI Infrastructure Technology And Services Limited, Plot No. 3, Sector 11, CBD Belapur, Navi Mumbai – 400614

PAN PDC Incharge – Kolkata region

- UTI Infrastructure Technology And Services Limited, 29, N. S. Road, Ground Floor, Opp. Gilander House and Standard Chartered Bank, Kolkata – 700001

PAN PDC Incharge – Chennai region

- UTI Infrastructure Technology And Services Limited, D- 1, First Floor, Thiru-Vi-Ka Industrial Estate, Guindy, Chennai – 600032

PAN PDC Incharge - New Delhi region

- UTI Infrastructure Technology And Services Limited, 1/28 Sunlight Building, Asaf Ali Road, New Delhi - 110002

FAQs on Form 49AA

- What is a Form 49AA used for?

- Can I fill up a Form 49AA in my regional/native language?

- Is it necessary to provide all of my contact numbers?

- How can I apply for a PAN Card?

- What are the documents that I need to submit when applying for a PAN using a Form 49AA?

- Driving licence

- Passport

- Arm’s licence

- Any photo identity card issued by a government body

- Pensioner card with photograph of the applicant

- Bank certificate

- Electricity bill

- Landline bill

- Broadband connection bill

- Water bill

- Consumer gas connection

- Bank account statement

- Depository account statement

- Post office passbook

- Passport of the spouse

- Passport

- A domicile certificate that is issued by the government

- Aadhaar card

- Employer certificate

- What are the various payment channels that are available for making a payment for your PAN?

- In the case of disability, can I use my left thumb for signing a PAN application form?

Foreign residents living outside of India who want to apply for a PAN in the country will have to fill in a Form 49AA to do so.

No, you cannot. A Form 49AA should be filled up in English only. The form must be filled up in block letters while leaving an empty box in between words that require a space.

Yes. This will help provide more channels of communication if there is any extra information required from your end.

You can use Form 49AA/49A which are legal forms required when applying for a Permanent Account Number.

You will have to submit documents pertaining to Proof of Identity (POI) and Proof of Address (POA).

Documents for Proof of Identity:

Documents for Proof of Address:

An applicant can make a payment either by using a demand draft, credit card, debit card or even net banking.

Yes, you can use your left thumb impression for signing a PAN application form. As per the guidelines released by NSDL, irrespective of disability or not applicants are required to provide their left thumb impression or provide their signature in the application form that is required to be submitted for availing a Permanent Account Number (PAN) or to carry out changes/correction in the existing card issued by the Income Tax Department of the country.

List Of Pan Card Office in India 2019

India Form 49aa

Other Pan Card Forms

*Disclaimer

A PAN card application form, referred to as Form No.49A or Form49AA, is used for the allotment of the Permanent Account Number (PAN).

PAN cards are essential for the Income Tax Department to identify taxpayers. As such, each earning citizen of India is required to have a PAN card for correspondence, TDS / TCS credits, specified transactions, returns of wealth / FBT / gift / income, tax payments, etc.

In case you have never made an application for a PAN card before, following are the procedures through which you can apply for and avail the same.

There are two PAN application forms:

Form 49A must be filled in by Indian citizens who are located within or outside the country, while Form 49AA must be used by NRIs.

These are the forms that are essential for PAN cards with free downloadable links:

S No | Forms | Description | Download Pan Card PDF Form |

1 | 49A |

| |

2 | 49AA |

|

Procedure for Filling Online PAN Card Application Form 49A / Form 49AA

There are four options for filling PAN card application online:

- Physical form submission along with documents

- e-Sign option

- Digital Signature based

1. For Physical submission mode

In this method, after the online data entry, the applicant will have to print out the form, attach photos and send the application along with required documents. Given below is the process involved:

Step-1 Choose the category of the individual applying for a PAN card

Step-2 Complete the form with all the required details and cross-check to verify that the information provided is accurate before proceeding to pay.

Step-3 Make the payment online and you will receive a duly filled Form 49A / Form 49AA along with the payment receipt in your email.

Step-4 Get a print out of the form and affix two passport-sized photographs to it.

Step-5 Sign the form and attach the supporting documents as required

Step-6 Send it to NDSL at Income Tax PAN Services Unit, NDSL e-Governance Infrastructure Limited, 5th Floor, Mantri Sterling, Plot No.341, Survey No.997/8, Model Colony, Near Deep Bungalow Chowk, Pune - 411016.

Nsdl Pan Application Form 49a Pdf

2. e-KYC-based

In this method, the applicant's Aadhaar details will be taken for the PAN card application. The PAN card will be sent to the residential address that has been given in the Aadhaar card. It is not necessary to send a PAN application along with documents to NSDL.

3. e-Sign option

In this method, one has to upload required documents and scanned photo while completing the application form. Attested documents will have to be submitted physically to NSDL.

4.Digital Signature based

In this method, one has to upload documents and images and then send the attested supporting documents to NSDL.

Tips to Fill PAN Card Application Form (Form 49A /Form 49AA)

Do's | Don'ts |

|

|

Documents Required for PAN

Individuals and Hindu Undivided Families (HUFs)

- Proof of address

- Proof of Identity – Voter ID, Driving License, Passport, Aadhaar, etc

For other categories

- A copy of the registration certificate of the company

FAQs

- Can you correct information that was submitted earlier for PAN online?

Yes.

- How can I pay my PAN application fee?

- Debit card

- Credit card

- Net banking

- Demand draft

- What is the application fee to apply for a PAN card?

The application fee is Rs.93 without Goods and Services tax for an address that is in India. In case of an international address, the fee is Rs.864 without Goods and Service tax.

- How long will it take for my PAN card application to be processed?

After the payment has been made and the applicant has sent all the required documents to UTITSL/NSDL, the application will be processed.

- When is form 49A used?

This application form is used when applying for a PAN card for the first time. Also, it can used in case of correction of information on the existing PAN card.

- Can you track the status of your PAN card?

Yes. This can be done online by logging on to Status Tracker. You will have to choose the type of application, key in the acknowledge number, enter the captcha code and then click on ‘Submit’.

- How to obtain PAN card application status through SMS?

To get information about the status of your PAN card application through SMS. Type out NSDLPAN along with the 15-digit acknowledgement number to 57575. You can also contact the call centre at 020 – 27218080.

Other Utility Document Forms

Other Pan Card Forms

Pan Application Form 49aa Pdf

*Disclaimer